Autobooks

|

Autobooks makes running your small business easier than ever.

Ready to learn more?

|

|

|---|

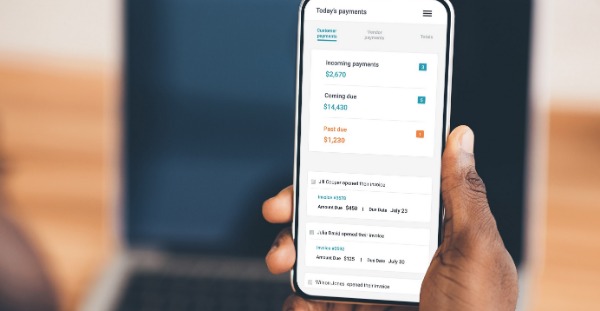

This solution integrates invoicing and digital payment acceptance into our online banking platform, which makes it easier for small businesses to request and accept payments. The Autobooks feature provides enhanced services that were previously unavailable, helping small businesses and non-profits to succeed.

Autobooks is built to be part of your everyday banking experience.

We have partnered with Autobooks to offer invoicing, payment acceptance, accounting, and more — all inside your online and mobile banking.

|

Interested in learning more? Get Paid and More | Autobooks

|

|---|

Our online banking platform now includes a seamless integration of invoicing and digital payment acceptance, providing small businesses with a convenient way to request and accept payments. With the introduction of the Autobooks feature, a range of enhanced services previously unavailable are now accessible, empowering small businesses and non-profits to achieve success.

Autobooks is also a complete accounting and bookkeeping solution.

Need more than invoicing and digital payment acceptance? Add on full financial management functionality — when you’re ready to do it all. |

|

|

Experience the difference with our business products and services, designed to get you back to

doing what you love.

Ready to learn more? Click Here |

.jpg) |

|---|

COMMON QUESTIONS

Below are a few questions we have been asked about Autobooks. If there is something specific you would like answered, please feel free to reach out to one of our Relationship Managers who would be happy to help you | 302-884-6885

Q: What is Autobooks?

A: Autobooks is a tool for business customers that allows you to send invoices, accept payments, and keep track of customers from inside online your banking platform.

A: Autobooks is a tool for business customers that allows you to send invoices, accept payments, and keep track of customers from inside online your banking platform.

Q: What are the benefits of using Autobooks?

A: With Autobooks you can:

- Create professional digital invoices

- Accept payment by credit/debit card or bank transfer

- Keep track of payments made or outstanding

- Generate reports like balance sheets, sales tax, and more

Q: Who is Autobooks for?

A: Business owners must have a checking account and access to online banking to enroll in Autobooks. The following business types are a great fit:

• Any business that bills/invoices for products/services

• Service-based businesses

• Non-Profits seeking to collect online donations

A: Business owners must have a checking account and access to online banking to enroll in Autobooks. The following business types are a great fit:

• Any business that bills/invoices for products/services

• Service-based businesses

• Non-Profits seeking to collect online donations

Q: How do I sign up to try it?

A: You can self-enroll right inside of online banking! Just log in and click on Autobooks payment tools to start. If you need help, reach out to us at 866-617-3122.

A: You can self-enroll right inside of online banking! Just log in and click on Autobooks payment tools to start. If you need help, reach out to us at 866-617-3122.

Q: Do I have to download any software to use Autobooks?

A: No. Autobooks lives completely inside of online banking, and no additional software is required.

A: No. Autobooks lives completely inside of online banking, and no additional software is required.

Q: Is Autobooks working with us (Artisans' Bank) as a financial institution? Is this safe?

A: Yes! Autobooks has partnered with Artisans' Bank along with other financial insititutions to bring you the best invoicing, payment, and accounting platform available on the market. Autobooks exceeds industry standards to protect customer information.

A: Yes! Autobooks has partnered with Artisans' Bank along with other financial insititutions to bring you the best invoicing, payment, and accounting platform available on the market. Autobooks exceeds industry standards to protect customer information.

Q: I already have QuickBooks. Why should I switch?

A: Autobooks is an extremely affordable accounting solution with features that are the right size for a small business. Complete accounting tasks right in online banking, without having to upload or download your banking data to another app.

A: Autobooks is an extremely affordable accounting solution with features that are the right size for a small business. Complete accounting tasks right in online banking, without having to upload or download your banking data to another app.

Q: How is Autobooks different from QuickBooks?

A: Autobooks is built directly into online banking, so you don’t need multiple logins. Additionally, Autobooks is designed with small business owners in mind (not accountants) so it’s streamlined to focus on receivables, payables, and cash flow.

A: Autobooks is built directly into online banking, so you don’t need multiple logins. Additionally, Autobooks is designed with small business owners in mind (not accountants) so it’s streamlined to focus on receivables, payables, and cash flow.

Q: Can Autobooks replace QuickBooks?

A: For most small businesses, it can. Autobooks is a simple way to keep your business accounting organized right within online banking. You can even import your QuickBooks data right into Autobooks so you can see the difference for yourself. Some businesses do choose to add Autobooks on top of their existing systems to utilize our payment tools.

A: For most small businesses, it can. Autobooks is a simple way to keep your business accounting organized right within online banking. You can even import your QuickBooks data right into Autobooks so you can see the difference for yourself. Some businesses do choose to add Autobooks on top of their existing systems to utilize our payment tools.

For more information, contact us at

302-658-6881 or stop by any of our Branch Locations.